West Asia Conflict: A Serious Threat To Global Trade

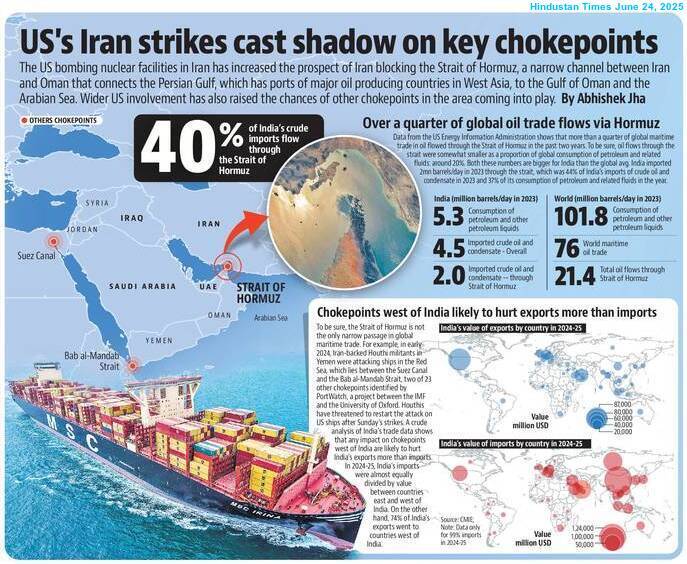

What if both maritime routes and airspace remain closed at the same time? This is the biggest worry for the global economy because of Iran’s ongoing conflict with Israel and the US. The Strait of Hormuz, which separates Iran from the Arabian Peninsula, is considered a strategically important waterway especially for the global petroleum trade. According to the International Energy Agency and the US Energy Information Administration, approximately 20 million barrels of oil or roughly 20% of the world’s total oil trade pass through the Strait of Hormuz daily. Hence, this crucial waterway is vital for the global energy supply, as it is the only route for various oil-producing nations in the Persian Gulf to export oil. Iran has repeatedly threatened to close this route, if Israel escalates attacks on the Islamic Republic.

History, however, offers some hope. During the Iran-Iraq War (1980-88), both sides targeted the Strait of Hormuz as a military objective, attacking merchant ships passing through this waterway. The conflict, also known as the Tanker War, involved attacks on commercial vessels to disrupt shipping and trade. However, they did not close this maritime route completely. According to market observers, if Iran closes the strait, its petroleum trade would also cease and the move certainly would have an impact on revenue. It seems that the Islamic Republic would not take such a huge risk.

However, the attacks of Israel and the US on Iran are virtually unprecedented. Therefore, it is difficult to predict Tehran’s response. The scenario has already triggered an uncertainty in the petroleum market, with crude oil prices rising by nearly 10% in a week. If the conflict continues, trade disruptions are almost certain (even if the Strait of Hormuz remains open). As a result, oil prices will rise and it would affect all the countries, especially those that heavily depend on petroleum imports.

On the other hand, the ongoing conflict in West Asia has prompted a number of airline companies to reroute their international flights mainly to avoid the region. Longer journeys necessitate carrying more fuel due to increased travel distance, which translates to more fuel consumption and potentially higher costs. Additionally, the greater distance can also lead to increased travel time and the need for more planning, as well as resources. Hence, the conflict has begun to have a significant (adverse) impact on the global civil aviation industry. As international travel remains important for trade even in the era of electronic communications, disruptions to air services affect global capital.

Geography, too, plays quite an important role. The Arab nations have emerged as crucial hubs of international air transport in the past few decades. With West Asia heating up, these hubs are also at risk because of the direct impact of the conflict on the global air transport system.

One can hardly predict the real impact of the conflict on the global economy, keeping in mind the current uncertain situation. Analysts are of the opinion that an increase in the prices of petroleum products triggers overall inflation, because all the sectors, including industry and agriculture, are heavily dependent on transportation. The Central Banks (of various countries) would have no other option, but to deal with inflation on an urgent basis. The Central Banks recently started easing the monetary policy. However, they would have to suspend it and to raise interest rates, if inflation takes place. It would have an impact on investment, as well as the rate of employment.

Again, if global capital seeks safer assets out of fear (of war), investment will still suffer. The web of the global economy entangles countries that are geographically located far from West Asia. This is the ultimate truth of the globalised economy. Disruption of peace in any part of the world is basically a global danger.

Earlier,

Boundless Ocean of Politics on Facebook

Boundless Ocean of Politics on Twitter

Boundless Ocean of Politics on Linkedin

Contact us: kousdas@gmail.com