A ‘Rare’ Opportunity

Competition for key minerals around the world is reshaping the global geopolitical relationships, supply chain strategies and even economic policies in the 21st Century. As the world moves towards environmentally-friendly energy, demand for lithium, cobalt, nickel and Rare Earth Elements (REEs) is rising significantly. Hence, the competition between different countries, too, is on the rise. As these resources are concentrated in a handful of countries, especially China, the rest of the world is striving to achieve self-reliance in this particular sector in order to ensure energy security, technological independence and economic stability. India is no exception as the South Asian nation heavily depends on China to meet its demand for Rare Earth Minerals (the 15 lanthanides – lanthanum (La), cerium (Ce), praseodymium (Pr), neodymium (Nd), promethium (Pm), samarium (Sm), europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb) and lutetium (Lu) – plus scandium (Sc) and yttrium (Y)).

To reduce India’s dependence on China, the Narendra Modi Government launched the National Critical Minerals Mission (NCMM) worth approximately USD 4 billion in April 2025. Now, India has decided to launch a new project in an attempt to emphasise the recovery or recycling of rare minerals from discarded electronic products or old cars as a part of the NCMM. The Cabinet has also approved a USD 170 million incentive programme to boost recycling of critical minerals from batteries and electronic waste (e-waste), stepping up efforts to secure access to rare earths. The scheme, which will run from fiscal 2026 to 2031, is aimed at building domestic capacity to recover minerals from discarded electronics and used batteries.

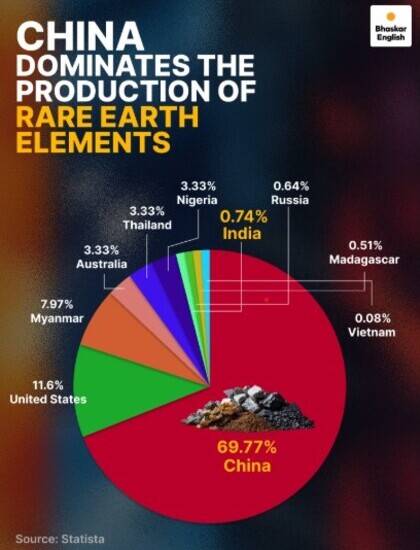

It may be noted that the Rare Earth Minerals are essential for electric vehicles, wind turbines, defence systems and various modern electronic gadgets because of their unique magnetic, as well as phosphorescent, properties. Although the raw geological availability of Rare Earth Minerals is spread globally, China has achieved dominance in this sector through early investments in refining technology, large-scale operations and a focus on value-added processing over primary extraction. The Asian Giant has leveraged lower labour costs and less stringent environmental regulations to build its processing capacity, thus making its operations the most cost-efficient. It allows China to control the supply of refined REEs. Currently, China controls 60-70% of global REE production, 85% of processing and 85-90% of REE refining.

Interestingly, Beijing has also demonstrated a history of using its control over REE supply chains to achieve geopolitical advantages, particularly through export restrictions and quotas that impact global technology production and supply chains for industries, like automotive and defence technology. It has affected India, as well. A number of countries have started collecting and recycling REEs from discarded products, like e-waste, to reduce their dependence on China.

E-waste recycling is a viable and strategically important option for India (which generates over 3.2 million tonnes of e-waste annually, making it the third-largest producer globally) to meet its REE needs, providing economic value, reducing reliance on imports, creating green jobs and protecting the environment. Recycling such minerals from electronic waste reduces hazardous waste disposal, including excavation, apart from protecting ecosystems.

So far, India’s self-sufficiency in Rare Earth Minerals has been hampered by a lack of domestic processing and refining capabilities, high exploration and extraction costs, technological dependence on other nations, environmental concerns from mining, challenges in attracting private investment and a prolonged approval process for mining projects. However, the global geopolitical crises have presented India with a strategic opportunity.

India needs to implement policy reforms, including effective implementation, develop improved recycling management, and collaborate with domestic and international partners in order to build a strong supply chain in this particular sector. Otherwise, its hope for REE self-reliance shall remain dim.

Boundless Ocean of Politics on Facebook

Boundless Ocean of Politics on Twitter

Boundless Ocean of Politics on Linkedin

Contact us: kousdas@gmail.com