Populist Politics, Irrational Economics

The most powerful President of the world has proved that he can put the Global Economy on the brink of collapse without (triggering) a World War or a pandemic. Experts have predicted that US President Donald John Trump‘s Tariff Policy might trigger a global recession soon.

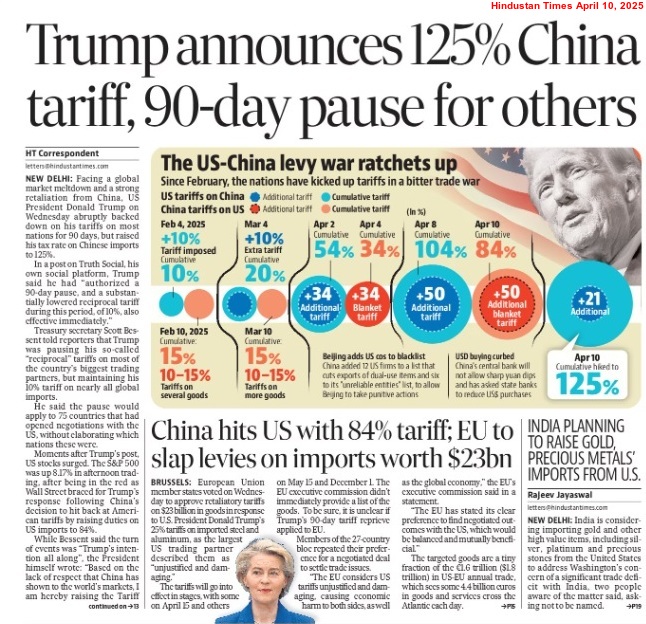

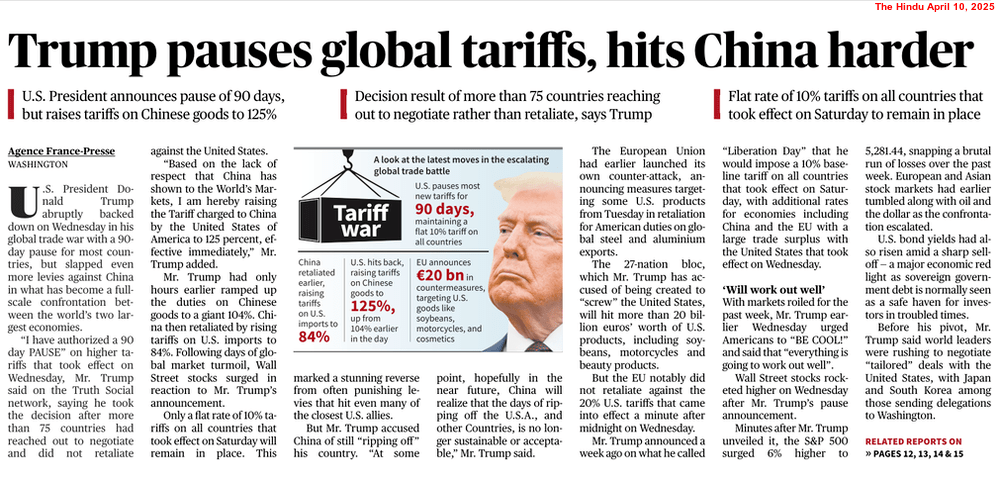

Different countries have reacted in different manners since the US President unveiled the Policy of Reciprocal Tariffs on April 2, 2025, announcing sweeping tariffs on imports from all countries, including a 10% baseline duty and higher rates. While major economic powers, like China and Canada, have chosen a policy of retaliation, the European Union (EU) has paved the way for negotiations after primarily proposing higher tariffs on US imports. However, smaller economies, heavily dependent on the US, have gradually surrendered to President Trump. India is still hesitant as the Narendra Modi Government in New Delhi is not in a position to ruin trade ties with the US, at least in the short-term.

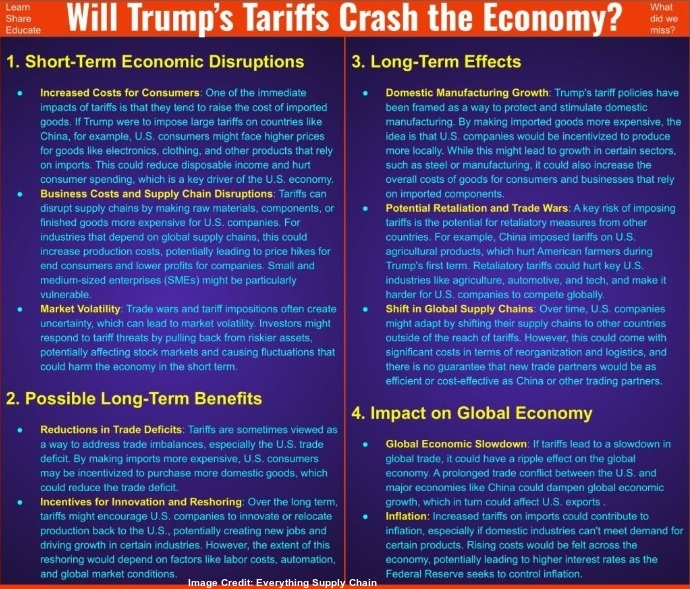

Regardless of reactions of different countries, the increased US tariffs would certainly affect the World Economy mainly because of their impact on supply chains in the Era of Globalisation. Production, too, would be severely affected. It is not possible for other countries to keep their trade ties intact by completely ignoring the US. One should keep in mind that the decline in demand in the US market would reduce demand for goods produced in other countries.

Furthermore, geopolitical issues are also involved in global trade. The global economy would become more dependent on China in the absence of the US and it is not at all acceptable to many countries. If a country, like India, depreciates its currency significantly against the US Dollar, then increased tariffs would not have an impact on the price of Indian products in the US market. However, the cost of imports from the US would increase. Hence, such a move is not acceptable.

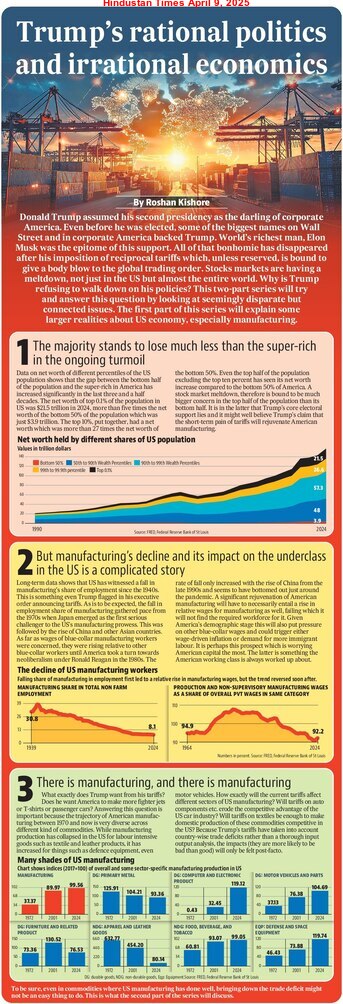

Trump has disrupted not only the global economy, but also the US economy which is largely dependent on imports. Higher tariffs on foreign products would increase the cost of imports and have a direct impact on their prices. Therefore, the US would experience inflation and the purchasing power of its citizens would decrease in the short-term. Interestingly, the Trump Administration has argued that lesser foreign imports would increase domestic production in the US, leading to higher employment and wages. Perhaps, the President has failed to realise that the US companies are not yet ready to produce enough products in order to meet the demands of its domestic market. It is also not possible for those companies to increase their production capacity without getting an idea about the future of the US economy.

Another important issue is whether the US companies would invest more to boost production, in spite of knowing the fact that the purchasing power of the US citizens would decrease sharply in the coming months. Hence, there is a possibility that the US would face inflation, as well as economic stagnation, at least in the medium-term. The economic growth rate would also take a hit and there would be intense political repercussions of this.

President Trump launched the Tariff War in the pretext of preventing the export of US products abroad. Analysts are of the opinion that he would fail to tackle inflation and to maintain a steady economic growth. Maybe, the scenario would force him to show restraint in future.

Boundless Ocean of Politics on Facebook

Boundless Ocean of Politics on Twitter

Boundless Ocean of Politics on Linkedin

Contact us: kousdas@gmail.com